HHS Issues Updated Provider Relief Reporting Guidelines

New reporting requirements issued by the Department of Health and Human Services (HHS) Health Resources and Services Administration (HRSA) on Fri., June 11th extend the timeframes for recipients of Provider Relief Funding (PRF) to both use and submit reports on the use of the funds they receive. Prior guidance had indicated that most funding would need to be spent by June 30, 2021 and had set report submission deadlines in February and July. While providers were able to register for the Reporting Portal, submission of actual reports was on hold pending further guidance.

While many of the data elements that recipients will need to report parallel those in the previous notice, the new guidance supersedes previous guidance and will be applicable to all past and future PRF payments. Importantly, for nursing homes, these reporting requirements now apply to infection control PRF payments as well, both those distributed to all homes and those distributed through the monthly Quality Incentive Program (QIP). Nursing homes should keep in mind that rules governing the use of infection control funding differ from those governing General Distribution funding.

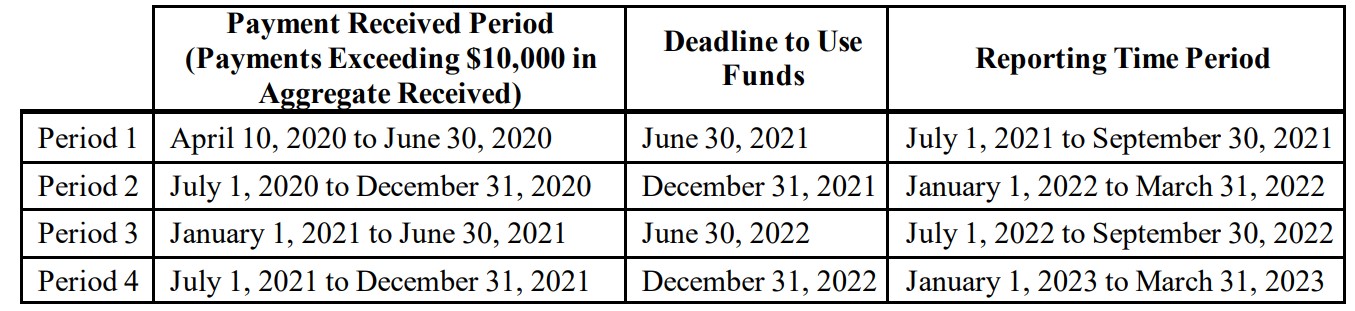

The guidance establishes four “Payment Received Periods,” each with a separate deadline by which funds received during the period must be used and a specified 90-day window for reporting such use. PRF recipients that received one or more payments during a specified Payment Received Period are required to report if they received payments that exceed $10,000 in the aggregate during that period. The table below outlines the timeframes associated with each of the four Payment Received Periods.

Members should note that the deadline to use funds received prior to July 1, 2020 is June 30, 2021. Reporting associated with this funding will need to be submitted during the July 1, 2021 through Sept. 30, 2021 window. For the purposes of registration and reporting in the PRF Reporting Portal, the Reporting Entity is the entity that registers its Tax Identification Number (TIN) and reports on payments received by that TIN and/or its subsidiary TINs. Organizations with parent and subsidiary relationships should consult the guidance document for detailed reporting responsibilities as well as the PRF Frequently Asked Questions (FAQs) (available here) that address ownership structures and financial relationships.

To be an allowable expense under the PRF, the expense must be used to prevent, prepare for, and respond to coronavirus. All expenses need to be supported by adequate documentation. Providers are required to maintain documents to substantiate that these funds were used for health care-related expenses or lost revenues attributable to coronavirus, and that those expenses or losses were not reimbursed from other sources and other sources were not obligated to reimburse them. The burden of proof is on the provider to ensure that documentation is maintained to show that expenses are to prevent, prepare for, and respond to coronavirus. Some examples of allowable PRF expenses are provided here.

While General Distribution PRF dollars may be used to cover lost revenues, and providers may use one of several ways of calculating losses, the guidance sets out the order in which uses of funds must be reported:

- Any Interest Earned on PRF Payments

- Any Other Coronavirus-Related Assistance Received (including business insurance payments, Federal Emergency Management Agency (FEMA), and Paycheck Protection and Small Business Administration programs)

- Expenses Funded by Nursing Home Infection Control Distributions

- Use of Other General or Targeted Distributions

- Other Unreimbursed Coronavirus Expenses

- Lost Revenue

The total PRF funding received will determine the reporting detail required. Reporting entities that received between $10,001 and $499,999 in total during a Payment Received Period are required to report on the use of funds in two categories: (1) General and Administrative Expenses; and (2) Health Care-Related Expenses. Those that received $500,000 or more in aggregated PRF payments during a Payment Received Period are required to report using additional sub-categories of expenses. This is true for General, Targeted, and Infection Control Distributions. Entities that spend $750,000 or more in federal funds inclusive of PRF payments during the organization’s fiscal year are subject to Single Audit requirements.

In addition to those listed above, the data elements that recipients will need to report include general information about the organization; information on any subsidiaries; tax status and classification information; personnel, patient, and facility metrics; and a series of questions regarding the impact of PRF payments. Those using PRF funds to cover lost revenues will be required to report revenue by payer as well as other detailed financial information.

HRSA intends to hold educational webinars that will include opportunities for question and answer sessions. The agency will also update and issue additional FAQs and a detailed PRF Reporting Portal User Guide to provide greater clarity about the reporting process.

PRF recipients that have not yet registered with the Reporting Portal should do so at their first opportunity to be prepared when it opens for reporting on July 1st. The process takes about 20 minutes and must be done in a single sitting. The portal site, which contains a step-by-step guidance document for completing the registration process, is here. HRSA warns that the portal is only compatible with the most current version of Edge, Chrome, and Mozilla Firefox browsers.

The guidance document, “Post-Payment Notice of Reporting Requirements,” is available here. An article from LeadingAge National, available here, provides clarification on several key issues.

Contact: Darius Kirstein, dkirstein@leadingageny.org, 518-867-8841