It has been 80 days since President Donald Trump declared a national emergency because of the COVID-19 virus.

Since then, almost every home health care agency has been adversely affected, with the vast majority of businesses experiencing sharp decreases in Medicare reimbursement, admissions and overall revenue, a new Home Health Care News survey reveals. While those general findings aren’t surprising, they support the idea that home-based care organizations need far more policy and payment support to stay afloat.

That’s especially true when taking into account providers’ simultaneous shift to the Patient-Driven Groupings Model (PDGM), according to Katie Smith Sloan, president and CEO of LeadingAge, a Washington, D.C.-based advocacy organization for the long-term care sector.

“The combination of [PDGM] coupled with the loss of income and increased expense of COVID-19 have placed extraordinary financial strains on many home health agencies,” Sloan told HHCN in an email. “The regulatory flexibilities and relief funds that have come through the administration and Congress have been helpful, but more support is needed.”

To get a sense of how home health providers were being affected by the coronavirus, HHCN initially surveyed roughly 150 industry representatives toward the middle of March. At the time, just 31% of respondents said their agency’s home health operations had experienced some form of COVID-19 disruption, with only 59% of respondents believing the virus was something that warranted serious concern.

To some extent, that relatively stable, early outlook can be attributed to many home health providers believing they’d have access to personal protective equipment (PPE) and COVID-19 testing supplies moving forward. But that has not been the case, and, as of June 1, even nursing homes — the hardest-hit sector in terms of COVID-19 cases and deaths — remained ill-equipped.

“There are just too many [nursing homes] out there — and other aging services providers — that are still desperately in need of testing and personal protective equipment,” Sloan told Skilled Nursing News last week during a podcast conversation.

Due to a lack of resources, patient anxietities and the continued spread of the coronavirus despite widespread shelter-in-place orders, the situation has quickly snowballed for home health providers.

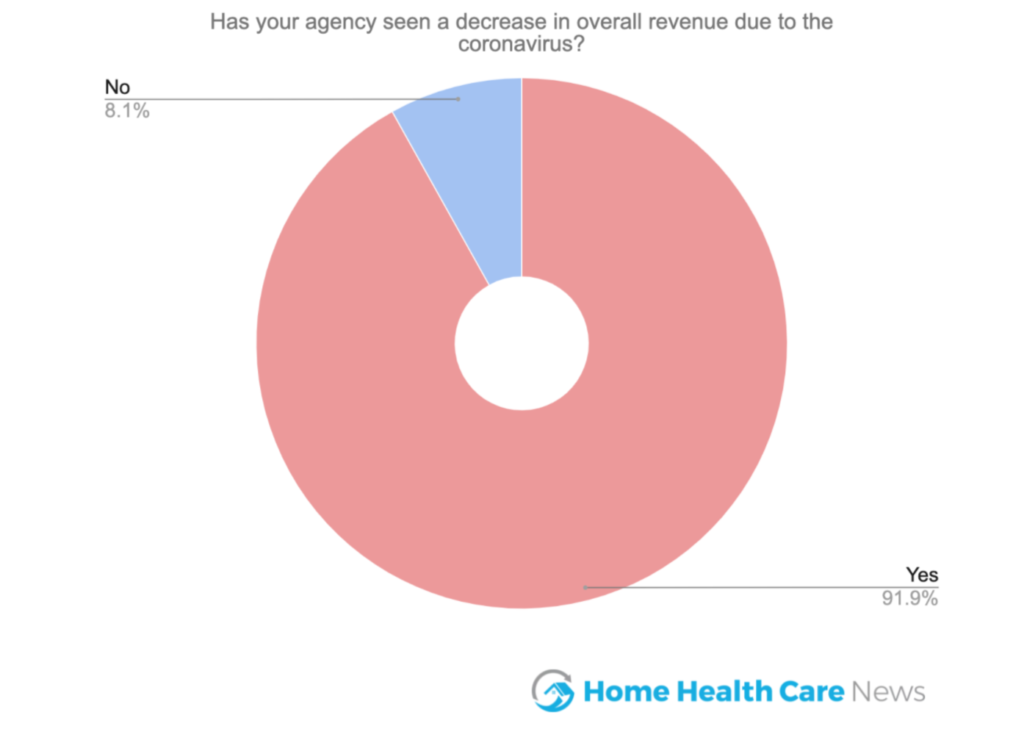

In a second, follow-up survey of more than 100 home health industry representatives, nearly 92% of respondents said their agency’s overall revenues were down because of the coronavirus.

“That certainly tracks with what I’ve heard from home health agencies across the country,” Joanne Cunningham, executive director of the Partnership for Quality Home Healthcare (PQHH) told HHCN. “Revenues are down. Admissions have been down. I think the whole health care system has taken a huge hit in different respects, but certainly home health care because of how the system has locked up for non-COVID-19 patients.”

PQHH, also headquartered in D.C., is an advocacy organization that represents a variety of home health providers across the country.

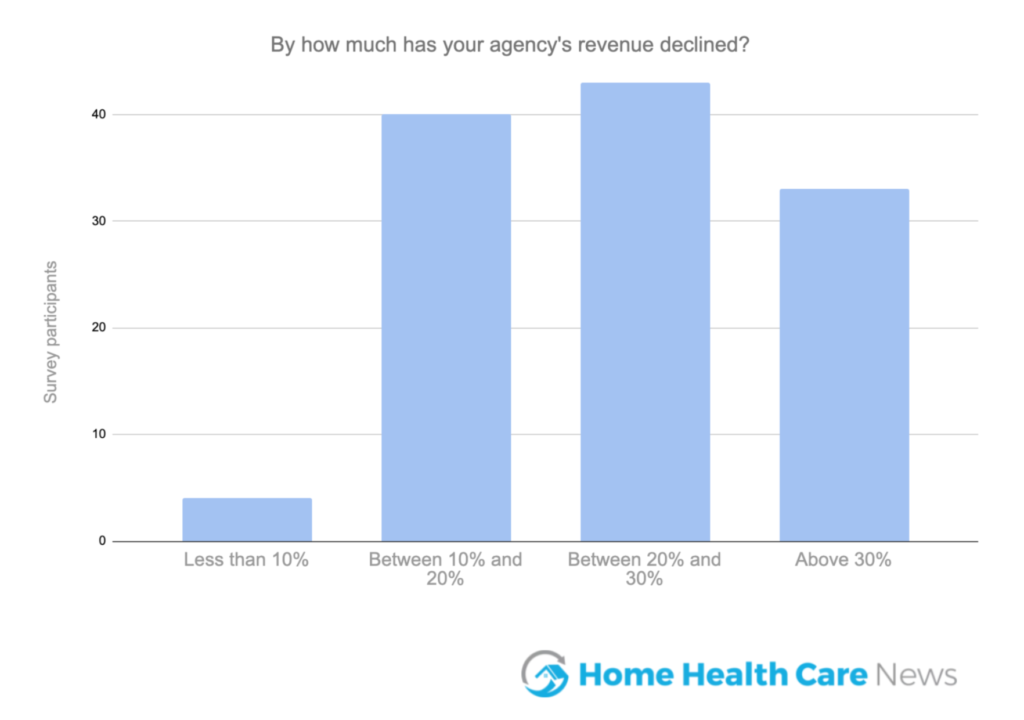

Of the respondents who experienced a revenue dip, nearly two-thirds said revenue was down by at least 20%, according to the survey, which HHCN conducted across four weeks in May.

The financial picture may not be the rosiest, but home health providers would likely be in an even worse position if not for the cash-flow relief efforts made possible by Congress and the U.S. Centers for Medicare & Medicaid Services (CMS), according to Cunningham. Those efforts include an expansion of CMS’s advanced and accelerated payment programs, plus the creation of a Provider Relief Fund under the Coronavirus Aid, Relief and Economic Security (CARES) Act.

Overall, CMS distributed more than $100 billion in advanced and accelerated payments to various health care providers from March through April. Broadly, the agency’s advanced and accelerated payment programs serve as cash advances that Medicare providers ultimately have to pay back.

Home health providers received just $1.7 billion before CMS shut down its expansion. Short-stay hospitals, comparatively, received more than $78 billion.

Separately, Congress created the Provider Relief Fund under the CARES Act to help health care organizations cover both direct and indirect costs associated with the coronavirus. The U.S. Department of Health and Human Services (HHS) began distributing the first tranche of relief funding — $30 billion — on April 10.

HHS is distributing $175 billion in total.

“It’s my understanding that both of those [measures] have been helpful to the home health sector,” Cunningham said. “Especially on the provider-relief side. Those are beneficial dollars that have helped to mitigate COVID-19 losses — and also the new expenses that home health is experiencing.”

While many home health providers have embraced the relief funds sent their way, others have rejected them, worried that regulators could one day try to claw some of the money back. Briningham, Alabama-based Encompass Health Corporation (NYSE: EHC) is an example of the latter.

“At the end of the day, we just felt, as a well-capitalized company, we had access to a variety of funding resources,” Encompass Health CEO Mark Tarr said during a recent investor presentation. “We just thought it was the best decision for Encompass Health to return the funds.”

Health care providers that plan to accept their relief funding need to agree to HHS’s terms and conditions by June 3.

On top of the aforementioned cash-flow relief efforts, some home health stakeholders have also called for a temporary, across-the-board reimbursement bump of 15%.

Patients returning

A main reason home health revenue is down is a decline in patient admissions. Elective surgeries — a main source of home health referrals — were postponed nationally for much of the past few months.

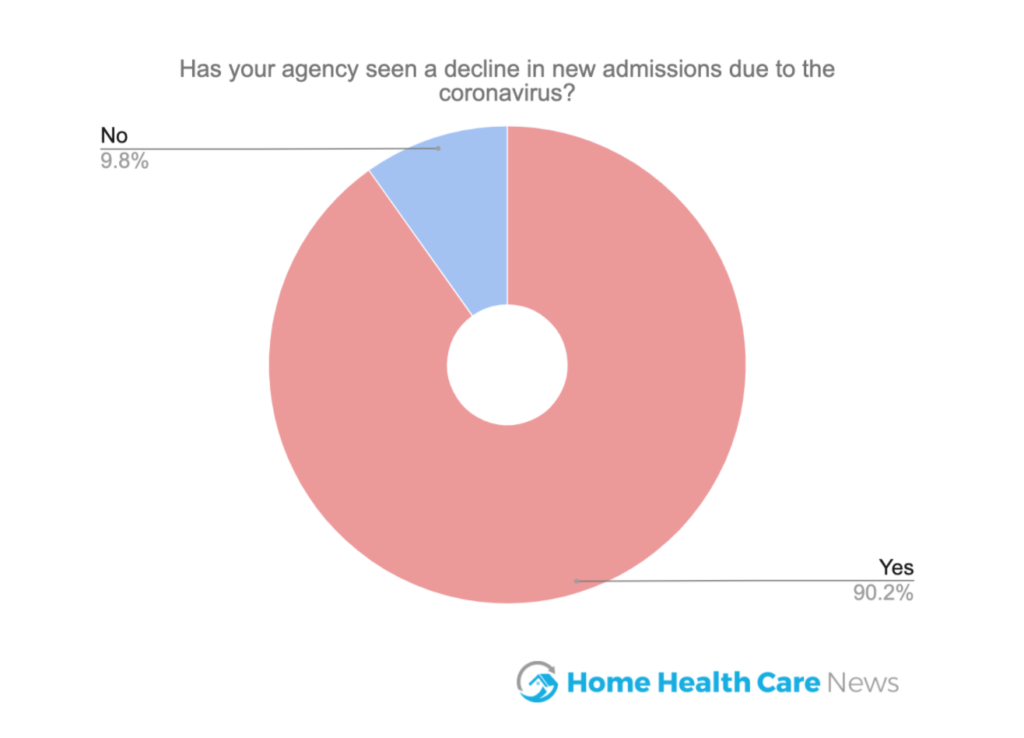

More than 90% of the individuals who took part in HHCN’s follow-up survey said their agency has seen a drop in new admissions due to the coronavirus. Of those, about one-third reported that their agency’s admissions dropped by more than 30%.

Elective surgeries have resumed in many areas, however, causing home health admissions to gradually return to normal levels, Cunningham noted.

“In places that have been limiting any sort of non-COVID-related health care or acute care services, that’s starting to unlock a little bit,” she said. “That’s leading to some normalization and having an impact on home health providers, who are seeing patients return.”

In addition to a drop in admissions, many home health providers are experiencing a decrease in visits per episode. That’s partly because some patients are canceling visits due to exposure concerns, and partly because providers are supplementing in-person visits with telehealth technology — which agencies can’t count as an official, billable visit.

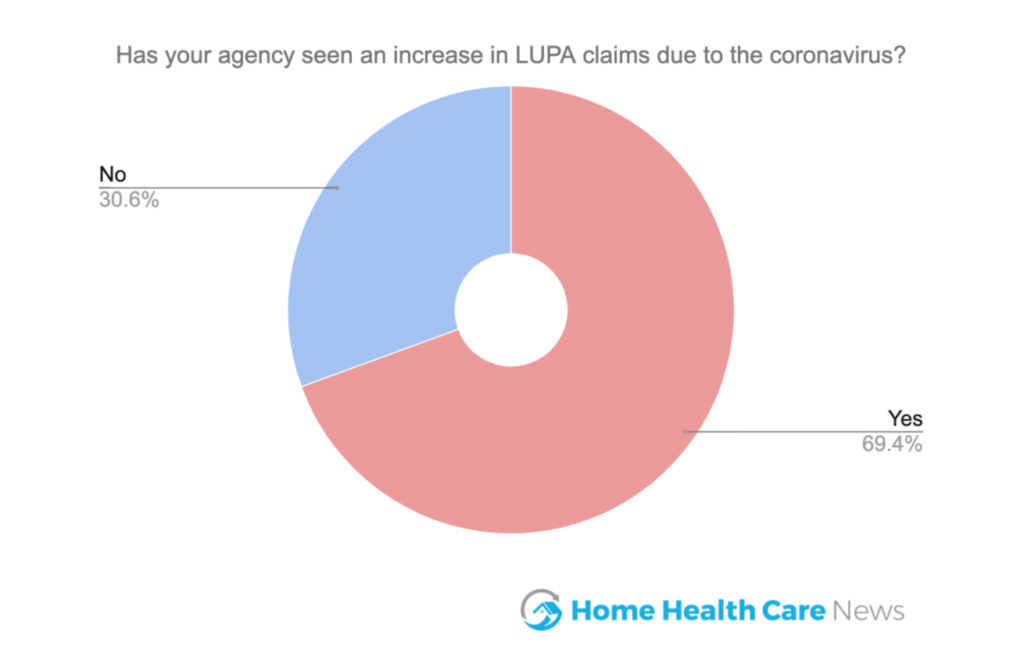

That trend, in turn, is causing low-utilization payment adjustments (LUPAs) to spike.

Nearly 70% of those who participated in HHCN’s survey said their agency’s LUPA rate has increased. Roughly 45% said their LUPA rates have increased by 20% or more.

Broadly, LUPAs reduce the amount of money home health providers receive during an episode of care. To reduce LUPAs amid the coronavirus, LeadingAge, PQHH, the National Association for Home Care & Hospice (NAHC) and others argue that telehealth visits should be counted as billable visits.

“Home health is essentially the only Medicare service yet to be granted reimbursement for telehealth services,” Sloan said. “While many of the skilled professionals involved in home-based plans of care, such as therapy disciplines, are authorized to bill Medicare for telehealth services, home health is not.”

Sen. Susan Collins (R-Maine) said she plans to introduce legislation aimed at home health telehealth reimbursement “soon.”